Making our investments work

It is not enough to simply focus on how our investments perform financially, we also look at how the companies we are investing in impact the environment and society as a whole. In part we do this because we believe, in the long term, those companies that operate ethically, sustainably and with good governance will perform better. But we also do this because it is simply the right thing to do!

What actions are we taking?

We have set a target of reducing the Weighted Average Carbon Intensity (Scope 1 and 2 emissions) score for the popular arrangement by 30% by 2030 relative to a 2022 base year.

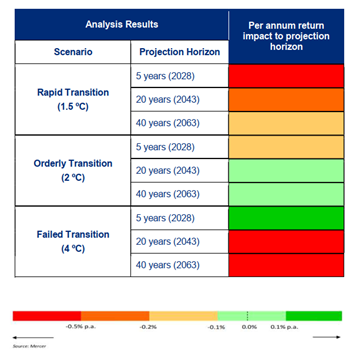

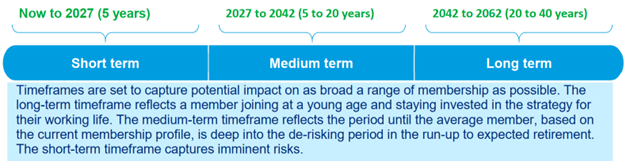

We have analysed the investment strategy for the DC Section popular arrangement on three climate scenarios for the time periods shown below.

This tells us that the DC Section will have long-term exposure to equities, directly and possibly via the diversified growth fund (‘DGF’) managers, as well as other growth type assets, which will cause member outcomes to be materially affected under a Failed Transition over the long-term.

We do not anticipate changing the overall strategy and asset allocation as the broader needs of members are best met through investment in asset classes that are expected to provide long-term growth. Instead, we will focus on engaging with the managers to gain a deeper understanding of the portfolios, and how risk within the current portfolios can be mitigated.

We will also continue to monitor the market for viable investment options that have a greater emphasis on carbon emission reduction, or other approaches that can further help to mitigate climate-related risk. A summary of our current action plan is shown below.

You can read our report to 31 March 2024 on ‘Climate change governance and reporting in line with the recommendations of the Task Force on Climate-related Financial Disclosures (“TCFD”) report by visiting the ‘Newsletters and reports’ section of our Scheme website.